SPUS and HLAL ETFs: ‘Shariah Compliant’ But Hardly Ethical

In substance, if not in form, the foremost halal ETFs deceive their Muslim unitholders.

It is probably accurate to say that most Muslim investors prefer funds to individual stock-picking. There is a presumption of safety, particularly in low-charging index-trackers and exchange traded funds.

In the US equity space, only few halal funds exist. The two ETFs focused on large US caps are the SP Funds S&P 500 Sharia Industry Exclusions ETF (SPUS) and the Wahed FTSE USA Shariah ETF (HLAL).

SPUS and HLAL are routinely recommended to beginner Muslim investors in the Western hemisphere, and those wanting to invest in halal American stocks from elsewhere. In fact, many are comfortable with concentrating their entire portfolios in these ETFs.

There is a problem, however. SPUS and HLAL may be Shariah compliant in the strict sense, but they are not Islamically ethical. Knowingly or inadvertently, they channel Muslim money into businesses that kill, maim and oppress the ummah without consequence. And most of the unitholders seem blissfully unaware.

Problematic holdings of SPUS and HLAL

Category I: Arms manufacturers

It has been close to 600 days since Israel launched its genocidal campaign in Gaza, with land grab and ethnic cleansing as the ultimate goals. Throughout this time, inaction has been a hallmark of most Muslim nations and their leaders.

In the absence of any meaningful action on a government level, the grassroots initiatives have been the sole alternative. Central among them is the Boycott, Divestment and Sanctions (BDS) movement. The focus as far as finance is concerned is on divestment.

Divesting from Israel and any business acting in support of the settler colony’s international crimes has been on the radar of institutional investors for years now given their obligations to stakeholders.

Retail investors, naturally, have been less involved. It does not mean they should be. Muslim investors have a religious duty to put their funds to good use. And that, more often that not, means avoiding certain types of investments.

Military companies, in particular, are omitted by practically all major Islamic stock indices, save one. The S&P Shariah Indices considers the manufacturing to be neutral if weapons go on to be used for permissible (i.e. self-defense) purposes.

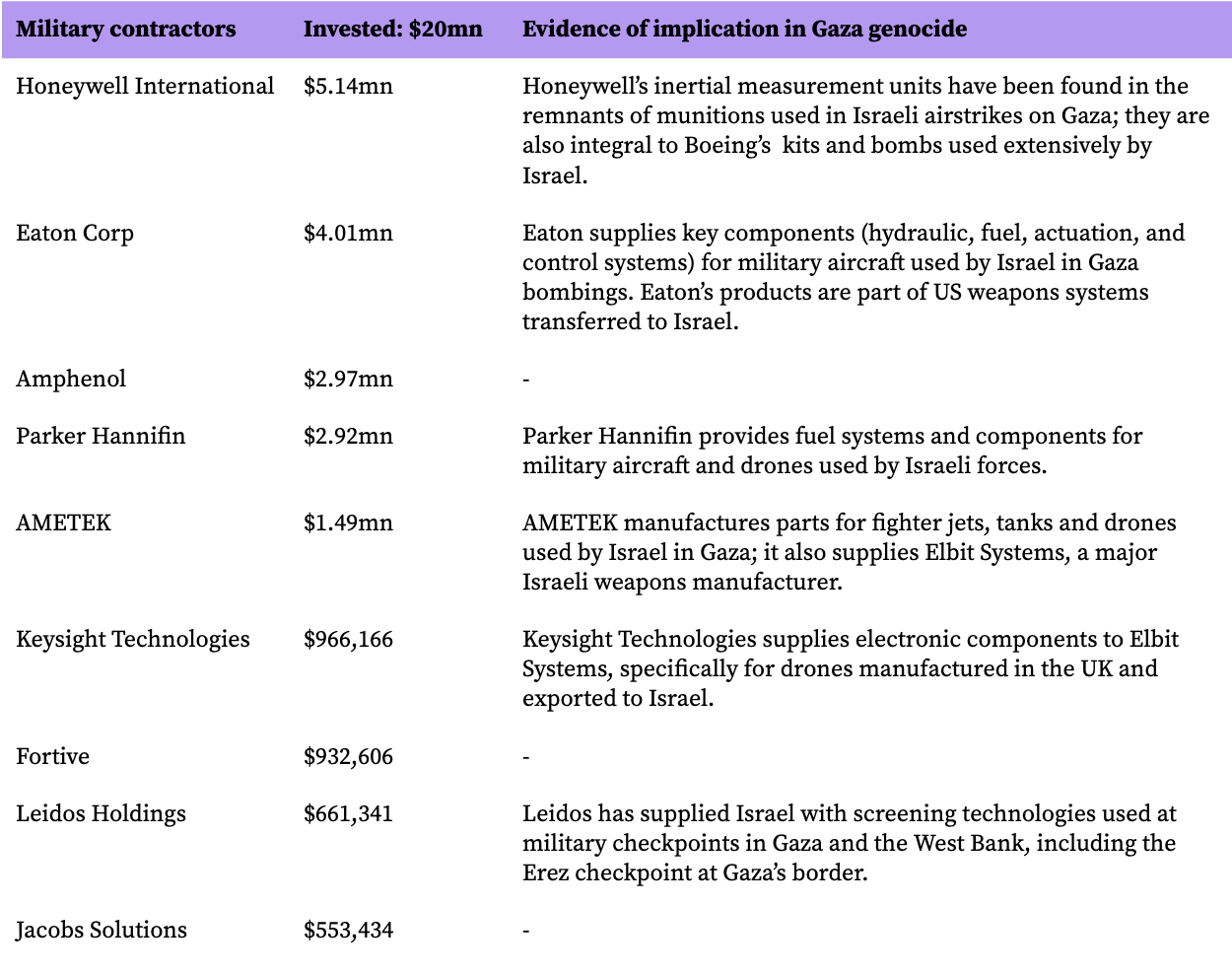

Could this be the reason why until very recently SPUS held arms manufacturers, nearly all of them implicated in Israel’s genocidal war in Gaza? The exposure was low but the very fact that such entities found a spot in a supposedly halal portfolio of stocks is unconscionable. The biggest stake was in Honeywell, the most egregious offender of the batch.

Several of these names have been long ago dropped by major institutional funds for manufacturing and distributing controversial weapons as well as sustained engagement with the Israeli military. Yet SPUS held them at least until 31 March 2025 — full 17 months into the latest round of attacks, widely described as genocidal. SP Funds had no excuse for its wilful blindness.

Category II: Technology companies

Weapons manufacturers though are not the only war profiteers; tech firms are now enabling Israeli military operations in their own way. A number of them are directly complicit in the genocide; AI is one of the biggest use cases.

Most Muslims agree on the moral imperative to disinvest from weapons manufacturers. Why do we then greenlight the systems of delivery of these weapons through software and hardware?

SP Funds is clearly not bothered. Its tech heavy ETF has its largest holding (11% or $129mn) in Microsoft, the leading supporter of the Israeli apartheid regime and the ongoing genocide in Gaza. Among the most committed champions of Israel is NVIDIA, the second largest holding in SPUS with 10%. Also in the top ten holdings are equally complicit Amazon and Alphabet; rounding up the list is Cisco.

Meanwhile, the other big Islamic ETF, HLAL, is heavily invested in the same offenders in addition to other longtime BDS targets like IBM, Dell and Hewlett Packard. Meta and Tesla are also infamously pro-Israel, each doing its part in promoting the Zionist agenda. Wahed’s “fight against Riba”, regrettably, does not seem to extend to fighting for the ummah whose blood is being spilled.

Islamic finance industry’s complacence

And blood has been spilled. Like never before. Yet the Muslims continue to “slumber in the shade of complacent safety”, the Islamic finance community no different. Almost two years into the genocide, only one Islamic stock portal (that I know of) has made a practical effort to incorporate the controversies as a feature on company pages.

Where are the Islamic financial institutions? What has occupied their Shariah boards? Where are the standard-setting bodies like the Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI)? Wahed’s open letter last year is yet to yield any results — for its own funds or the broader industry.

As the vanguards of Masjid Al Aqsa, Muslims do not have the right to stay passive. Especially now that there are fatwas calling for a financial jihad against Israel and its allies. Or have we relegated our responsibility for divestment to western campus activists and churches?

For the time being…

Consider investing independently, even if that means holding a few low-risk stocks at a time. Diversifying outside of western markets, particularly into Islamic finance hubs like Malaysia, is another way. These are good enough alternatives. The status quo is not an option.

Feel free to explore Tayyib Finance archives to explore some of the suggested halal investment ideas.