Muslim Nations Bow to Riba — Then Raise Their Hands for Divine Help

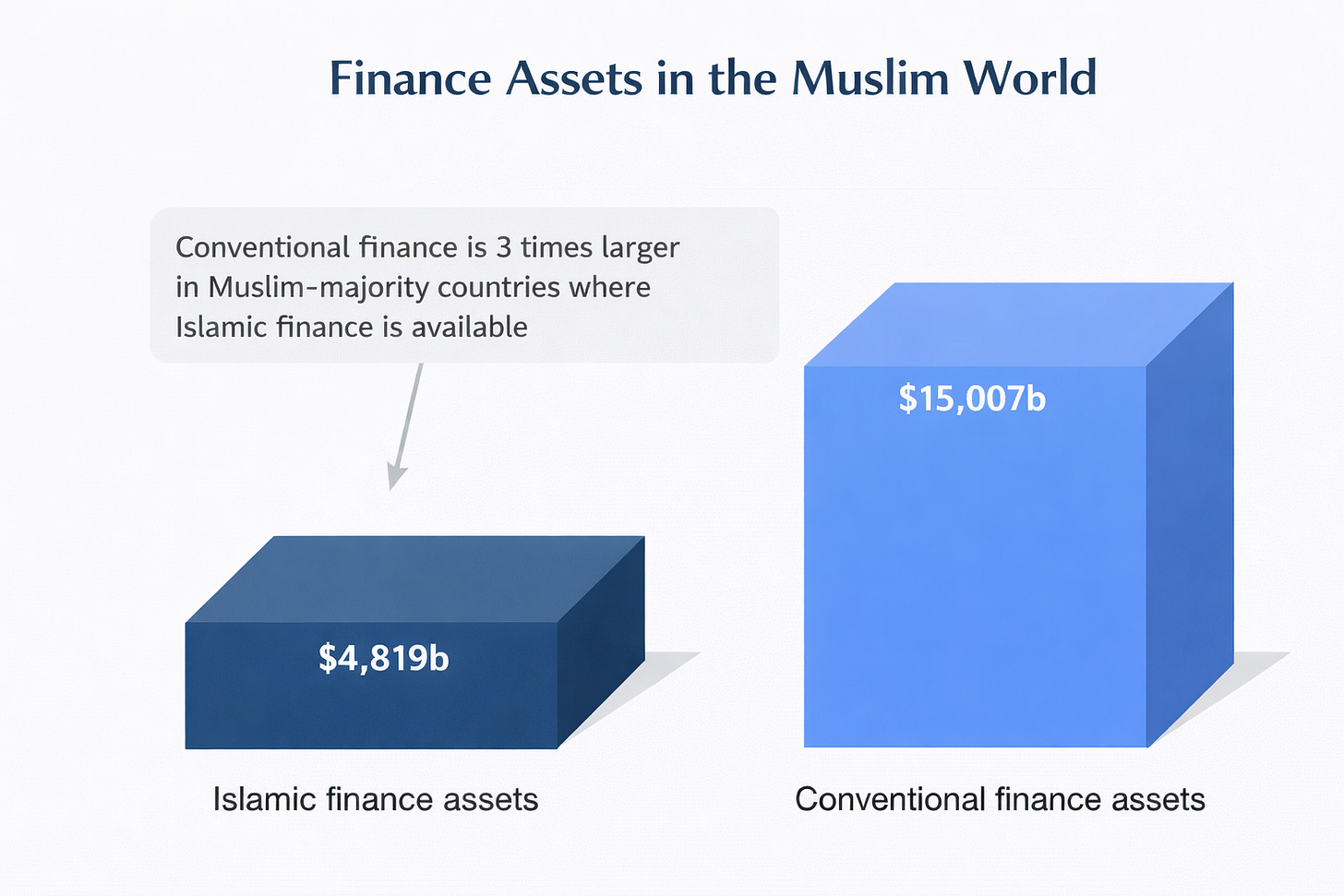

Conventional finance is three times larger in Muslim-majority countries where Islamic finance is available.

Finance is a key enabler of every economy, driving both wealth creation and wealth distribution. Conventional finance, however, is haram. In fact, riba (or usury) is so detested that it is the only sin that brings Allah’s declaration of war upon those who commit it.

Yet, the prevalence of conventional finance in our economies — even in Muslim-majority countries — suggests that many Muslims are either unaware or not truly fearful. Today, only a few nations have banking systems where the majority of financial activity aligns with Islamic principles.

With the immense wealth Allah has blessed us with, we must strive to build strong Islamic financial ecosystems. If Muslims themselves lack trust and confidence in Islamic finance, despite the severity of the warning against riba, how can we expect to attract others to our way, innovate and compete on the global stage?

Note: The data above is as of the latest available date and is intended to be directional rather than precise. The purpose is to highlight areas of opportunity and growth within the Ummah. Preview image by Salah Regouane on Unsplash.