Islamic Finance and the Abdication of Moral Responsibility

Islamic finance is an industry without a cause. It has failed the ummah and left Muslim investors to fend for themselves.

Whenever Islamic finance is talked about in some formal setting, terms like “equality”, “social responsibility”, “inclusion” are sprinkled around so generously that one readily assumes Islamic finance is the same thing as the (largely theoretical) notion of ethical finance. Hard facts from industry practices show that couldn’t be farther from reality.

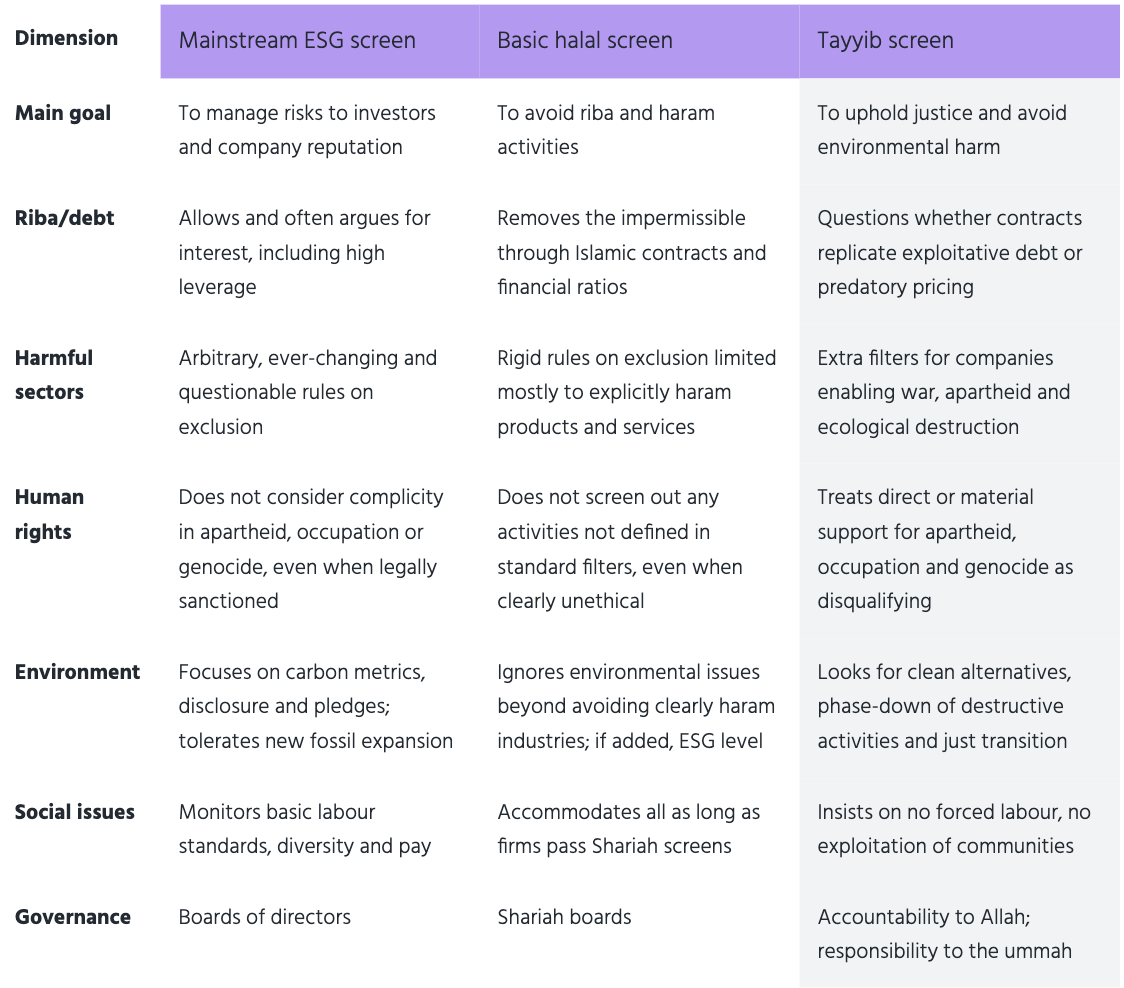

Just like conventional ESG ratings don’t signal real sustainability, Islamic finance — the way it is practised — doesn’t equal virtue. The industry has never truly moved beyond Shariah compliance in a narrow, legalistic sense. So-called “green” products, including Islamic bonds, have been little more than an attempt to milk ESG trends.

Genocide profiteers

Here is a clear case in point. US-based Islamic ETFs SPUS and HLAL are both built around supposedly valid Shariah indices and profess adherence to “socially responsible principles”. Yet they continue to profit from stocks of companies implicated in Palestine and other imperial wars. Their cumulative returns — in the 30–40% range from October 2023 to date — are the blood premium that their Muslim unitholders have been enjoying unawares.

As of mid‑December 2025, close to 60% of SPUS’s portfolio sits in companies that are either core BDS targets over Palestine (Big Tech cloud, AI and surveillance names) or major fossil‑fuel polluters such as Exxon Mobil.

Roughly 44% of HLAL’s portfolio is in either Gaza‑related Big Tech and surveillance platforms or fossil‑fuel producers and oil firms like Chevron and Halliburton that “fuel genocide, apartheid and climate disaster”.

From halal to tayyib

Tayyib is as Islamically rooted as halal though it has not taken off in the same way. It’s a shame, given that they appear in the Quran together in multiple verses, with halal defining legal permissibility and tayyib referring to purity and ethical sourcing. Since tayyib is thus broader in meaning, it would make complete sense to apply it in finance.

Islamic finance is only starting to look into tayyib, with some quarters producing broad principles that do not amount to anything in practice. Knowing how financial regulators operate and seeing how the AAOIFI has not budged throughout the Gaza genocide, we shouldn’t hold our breath on the tayyib finance project just yet.

Individual responsibility

Exposing Islamic financial practices as unethical is a bit like myth-busting. The truth is as Muslims we don’t even need to rely on western models of ethics that are fraught with moral relativism and greenwashing. We have an existing framework that is already perfect by design — and that is Shariah.

While all Islamic financial institutions, including fund managers, claim to follow it, Maqasid al-Shariah (objectives of Islamic law) are not fulfilled simply by being riba free (to borrow one of Wahed’s favourite lines) but require so much more in the realm of justice, for human welfare and the nature that has been entrusted to us.

To close the integrity gap in Islamic investing, Muslim investors who are disillusioned with superficial halal and ESG labels should consider applying the tayyib concept independently — by overlaying Shariah compliance and integrating justice, impact and stewardship to inform their investing decisions.

Say, “Not equal are the evil and the good, although the abundance of evil might impress you.” So fear Allah, O you of understanding, that you may be successful.

Al-Quran (5:100)

Below is an example of the tayyib screen being applied in practice:

5 Indonesian Halal Stocks: Tayyib Reality Check on EV Supply Chain Plays

Indonesia, home to the largest number of Muslims globally and the newest member of the BRICS bloc of rapidly growing emerging nations, remains a largely untapped source of Shariah compliant investment opportunities.