Halal Tayyib Stocks from Malaysia and Singapore, 2025 Update

What should Muslim investors buy to benefit from a low-interest environment?

Although Islamic finance purports to operate as an interest-free system, news about recent declines in interest rates is not irrelevant to Muslim investors. The fact is Islamic capital markets exist within conventional structures and are thus made to rely on interest-related developments.

Across regions, as inflation moderates and signs of economic weakness persist, central banks are starting to reduce interest rates in hopes of reigniting growth and riding out trade uncertainty. This bodes well for a broad spectrum of industries, some more than others.

Rising investor confidence has already resulted in stock market gains. In this post, I am looking at a selection of tayyib stocks — that are both halal and sustainable (ethically and environmentally) — from two major Southeast Asian economies, Malaysia and Singapore.

In Malaysia, the benchmark rate was cut by 25 basis points in July to 2.75%, for the first time since 2020. Singapore has also eased monetary policy in 2025, the first such move in five years, though it was done through exchange-rate rather than interest-rate targeting.

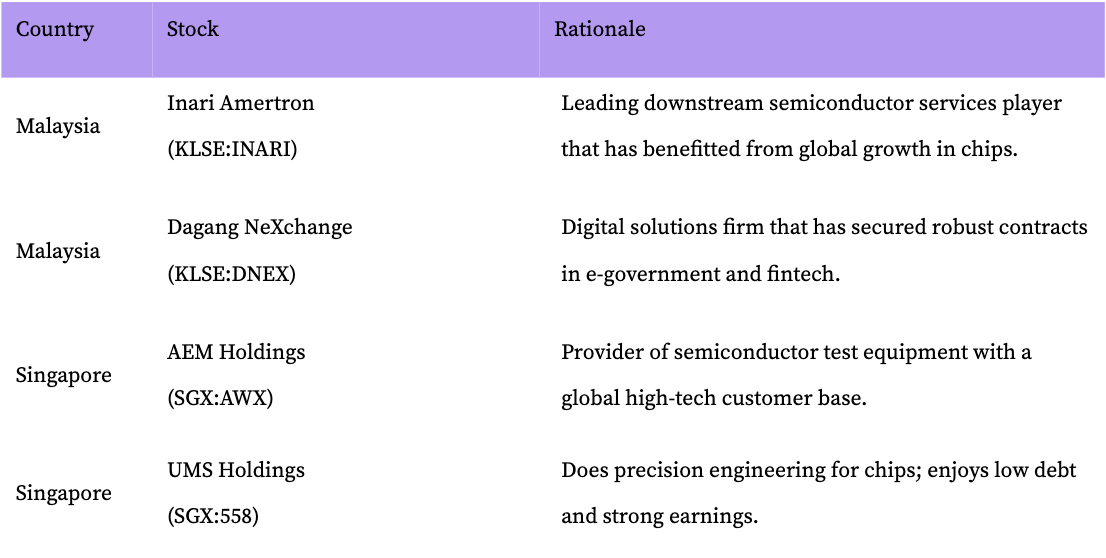

Technology

Tech stocks tend to be prime beneficiaries of a low-interest rate environment as capital for innovation becomes more affordable and future earnings more valuable in the present. For Muslim investors who do not wish to buy into companies implicated in wrongdoing, it is best to avoid multinational tech conglomerates and focus on regional stocks.

Here are a few tayyib opportunities in Technology:

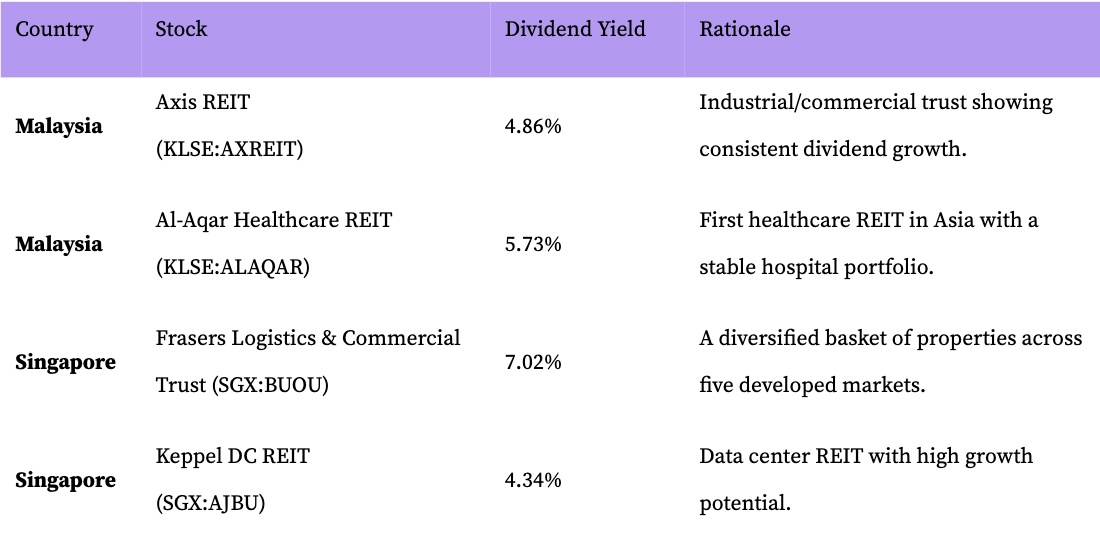

Property

Cheaper credit means greater property acquisition and development activity, which, in turn, means higher profitability for property stocks, including real estate investment trusts. REITs are a great option for dividend investors in particular. Malaysian REITs were previously covered here and here, along with a Singaporean REIT in focus.

These are some examples of halal REITs from Southeast Asia:

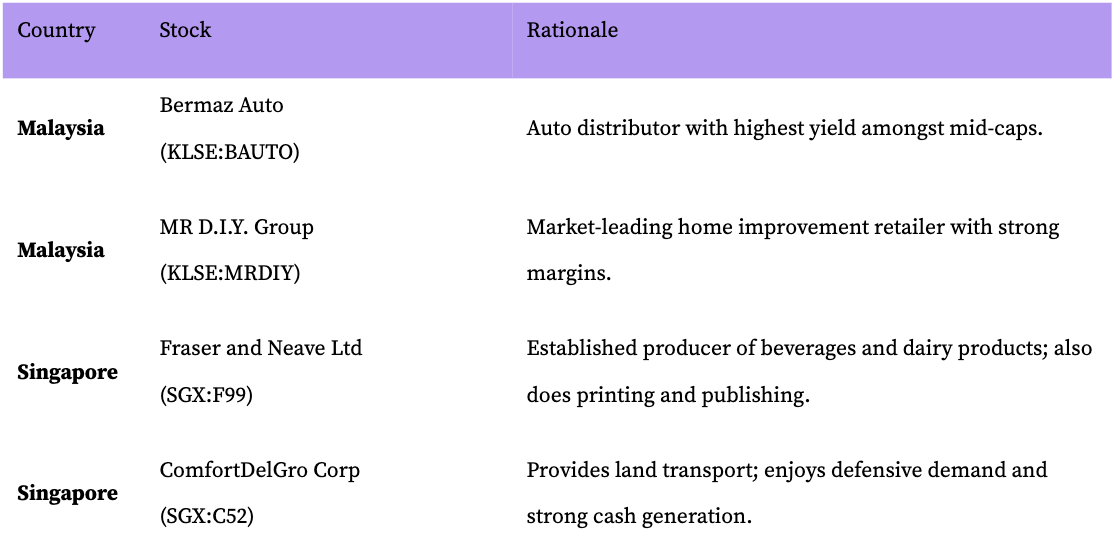

Consumer

The consumer sector will benefit from higher retail borrowing and spending that lower rates encourage. Below is a selection of halal stocks representing consumer discretionary companies specifically:

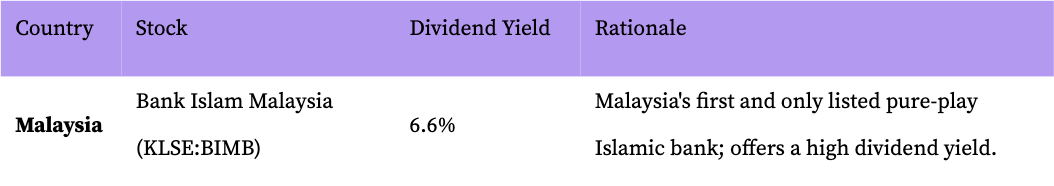

Finance

Banks and other lenders may see increased lending activity; in that sense, it is worth considering financial stocks as well. Between the two countries though, there is only one publicly listed full-fledged Islamic bank:

Takeaway

Many a Muslim investor become bothered upon learning that Islamic finance is so intimately connected to riba, or interest. It would be wrong, however, to wholly reject what this (imperfect) Shariah-based system offers in terms of alternatives to conventional financial products. After all, the ummah is in need of every avenue of strengthening itself for the sake of its weakest members, the oppressed peoples. Hence monitoring economic events and translating them into money-making opportunities, in a tayyib way, is a matter of great consequence as far as financially capable believers are concerned.

Disclaimer: Nothing you read on Tayyib Finance constitutes financial advice. There is no guarantee of Shariah compliance of any particular stock at any particular time, since ‘Shariah compliance’ is fluid depending on the provider of judicial opinion and must be regularly affirmed. Similarly, there is no assurance that the same stock is simultaneously ‘tayyib’ (or Islamically ethical). Do your own research.

Are you familiar with the above stocks or already hold any of them?