Halal and Tayyib: Visa vs Mastercard

Payment platforms powering our increasingly cashless world will continue growing. Muslims investors too can cash in on this trend.

The two payment processing giants need no introduction. But since they formally belong to the Financial Services sector, Muslim investors may need a reframing. Indeed, both Visa and Mastercard are halal since their primary business is technology-powered processing of transactions. The companies also fulfil the financial as well as sustainability criteria for tayyib stocks.

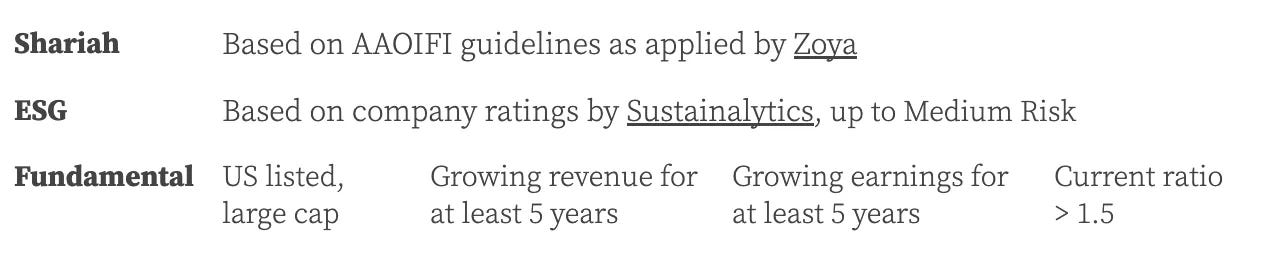

Interlude: The selection criteria

All stocks I cover fulfil the same basic criteria, in two areas. First, Shariah prescriptions which automatically eliminate companies in haram industries and those that exceed the stipulated debt or interest thresholds. To be tayyib, the remaining businesses also need to clear minimum environmental, social and governance (ESG) standards: at the very least, they shouldn’t profit from anything that is clearly damaging to the planet or its inhabitants. The other aspect is financial performance; I stick with the fundamentals to narrow down to businesses with a record of stable and reliable growth.

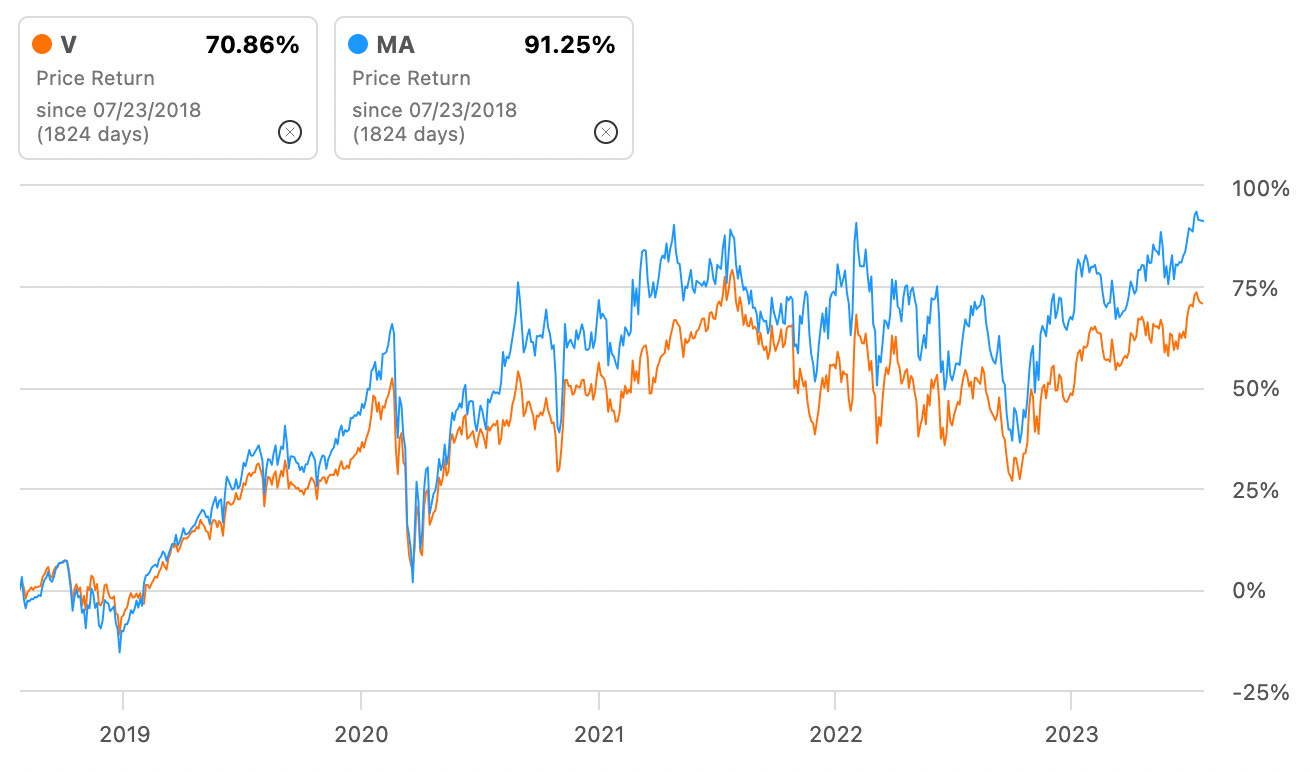

Note that neither Visa nor Mastercard pass my strict fundamental criteria. Their revenue and earnings have dipped in the last five years, but that was during Covid-19 between 2020 and 2021 — the period we may objectively exclude as anomalous.

Visa (NYSE:V)

Revenue (compounded 3-year average growth): 9.0%

Diluted earnings per share (compounded 3-year average growth): 10.4%

Long-term median earnings growth forecast: 14.9% per year

Visa is the runaway leader that processes almost twice as much volume (excluding China) as the closest competitor (that is Mastercard); in fiscal 2022, that came to $14 trillion. It has maintained its leadership for years and has, as a result, built a considerable moat. As a software firm, it is incredibly efficient too: its operating profit margin is close to 70%, while net income margin is around 50%.

Mastercard (NYSE:MA)

Revenue (compounded 3-year average growth): 10.3%

Diluted earnings per share (compounded 3-year average growth): 8.5%

Long-term median earnings growth forecast: 17.8% per year

Mastercard is in solid second size wise, although it produces higher returns: return on equity last stood at 154% (versus Visa’s 42%), return on capital at 38% (22%). Like Visa, the company is expanding international B2B/C and G2C/B business in markets with underdeveloped digital payment systems. Even now, Mastercard derives more than half of processing volume ($8 trillion in 2022) from overseas.

Thesis

Both Visa and Mastercard do exceptionally well. The former is larger but the latter is more internationally focused. One has better margins but the other has greater returns. Both possess excellent balance sheets, although Visa has an edge here. It scores higher on liquidity ratios and relies less on debt as capital. Nonetheless, looking into the future, both are predicted to grow at double-digit rates. At current prices, Mastercard is comparatively more expensive; its price-to-earnings ratio is higher on a forward basis too. All in all, Visa for the win.

Disclaimer: Nothing you read on Tayyib Finance constitutes financial advice. Nor is there a guarantee of Shariah compliance of any particular stock at any particular time, since ‘Shariah compliance’ is fluid depending on the provider of judicial opinion and must be regularly affirmed. Do your own research.