Halal and ESG Investing: Information Technology Consulting in Focus

Tayyib Finance introduces the best performing halal stocks that are also sustainable, empowering modern Muslims to invest responsibly.

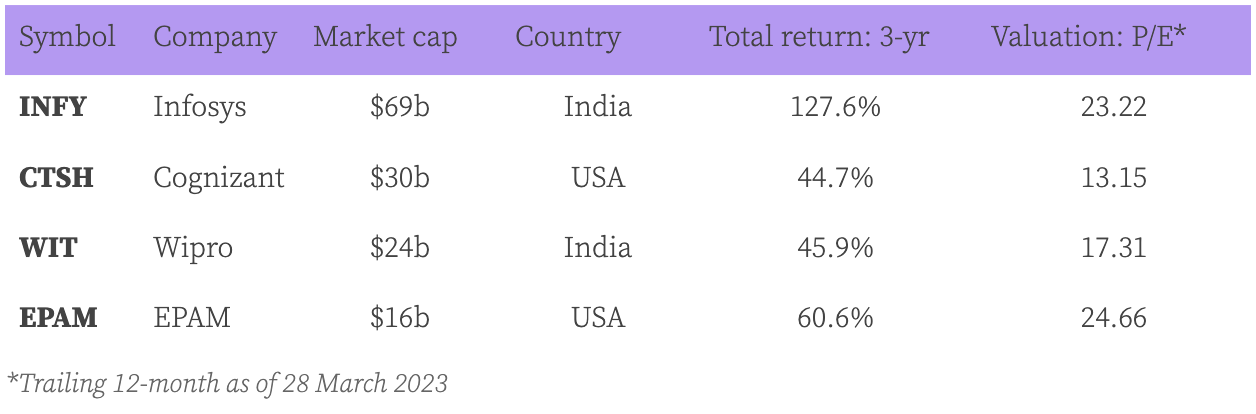

IT consulting is not the latest or most-hyped of industries but it is still growing at a brisk pace spurred by the ongoing transition of on-premises, legacy systems to cloud-based architectures. Muslim investors have a few choices.

Interlude: The selection criteria

All stocks I cover fulfil the same basic criteria, in two areas. First, Shariah prescriptions which automatically eliminate companies in haram industries and those that exceed the stipulated debt or interest thresholds. To be tayyib, the remaining businesses also need to clear minimum environmental, social and governance (ESG) standards: at the very least, they shouldn’t profit from anything that is clearly damaging to the planet or its inhabitants. The other aspect is financial performance; I stick with the fundamentals to narrow down to businesses with a record of stable and reliable growth.

Infosys (NYSE: INFY)

Revenue (compounded 3-year average growth): 12%

Diluted earnings per share (compounded 3-year average growth): 9.4%

Median earnings growth forecast: 12.1% per year

Headquartered in Bangalore, India’s Silicon Valley, Infosys is an established name in IT consulting covering everything from app development to product engineering to enterprise management. Under the current leadership, the company is enjoying a second lease of life.

Cognizant Technology Solutions (NASDAQ: CTSH)

Revenue (compounded 3-year average growth): 5%

Diluted earnings per share (compounded 3-year average growth): 10%

Median earnings growth forecast: 6.3% per year

Cognizant is a US consultant offering customer experience enhancement, robotic process automation, analytics and AI services. The company’s strong cash position allows it to continue investing in growth, particularly in the area of digital transformation where it has made a mark.

Wipro (NYSE: WIT)

Revenue (compounded 3-year average growth): 13%

Diluted earnings per share (compounded 3-year average growth): 7.5%

Median earnings growth forecast: 11.4% per year

Wipro is another Indian firm operating the usual range of IT services and products but also a separate segment dedicated to servicing government entities. With revenue expanding steadily thanks to high-value contracts, WIT is a good way to get exposure to the industry.

EPAM Systems (NYSE: EPAM)

Revenue (compounded 3-year average growth): 28%

Diluted earnings per share (compounded 3-year average growth): 16%

Median earnings growth forecast: 23.9% per year

An American outfit, EPAM (originally from Belarus founded by Arkadiy Dobkin) specialises in software and digital platform engineering. Often mentioned among the fastest growing public tech companies throughout the last decade, EPAM matured to the S&P 500 in December 2021.

Takeaway

All four halal stocks are decent contenders for investment but for different reasons. Infosys, the second largest listed Indian company, is resilient and has so far rewarded its shareholders the most. (Compare INFY’s 3-year total return of 128% to the US industry’s 43%; it also pays more dividends than the alternatives.) However, since past performance is not always a guarantee of future success, EPAM — which has the highest growth potential in addition to a flawless balance sheet — may look more appealing to some. You will need to pay up for it, to be sure: its price-to-earnings of around 25x exceeds the industry average of 23x. Cognizant is the cheapest of the lot by far.

Disclaimer: Nothing you read on Tayyib Finance constitutes financial advice. Nor is there a guarantee of Shariah compliance of any particular stock at any particular time, since ‘Shariah compliance’ is fluid depending on the provider of judicial opinion and must be regularly affirmed. Do your own research.